In the volatile world of precious metals, the dramatic price crash on 30 January 2026 has sparked widespread outrage & suspicion. Gold plummeted by over 10%, while silver suffered a staggering 27% drop in a single day. What appeared to be a market correction quickly revealed itself as something far more sinister: a coordinated effort to manipulate prices through futures contracts. This article delves into the evidence highlighting how these paper instruments are used to suppress physical demand & protect powerful financial institutions. If you’re an investor in gold & silver, understanding this could be crucial to safeguarding your wealth.

The Shocking Crash: A Ten Sigma Event?

Financial markets are no stranger to volatility, but the events of 30 January 2026 defy statistical norms. Described as a “ten sigma event” – an occurrence with a probability of one in 5.25 septillion years under normal conditions – the drop in precious metals prices was anything but natural. Analysts point to engineered manipulation, where massive sell-offs in futures contracts flooded the market, driving prices down artificially.

- Gold’s Fall: A -10.2% decline, equating to an -8.1 sigma event.

- Silver’s Plunge: A -27.6% drop, marking a -10.8 sigma anomaly.

Such extremes suggest deliberate interference, particularly when viewed alongside recent sigma events in the past five weeks. Critics argue that without external forces – like banks dumping paper contracts – these movements would be impossible. The timing raises eyebrows: just days before, major banks issued bullish price targets, only for the rug to be pulled shortly after.

Evidence of Manipulation Through Futures Contracts

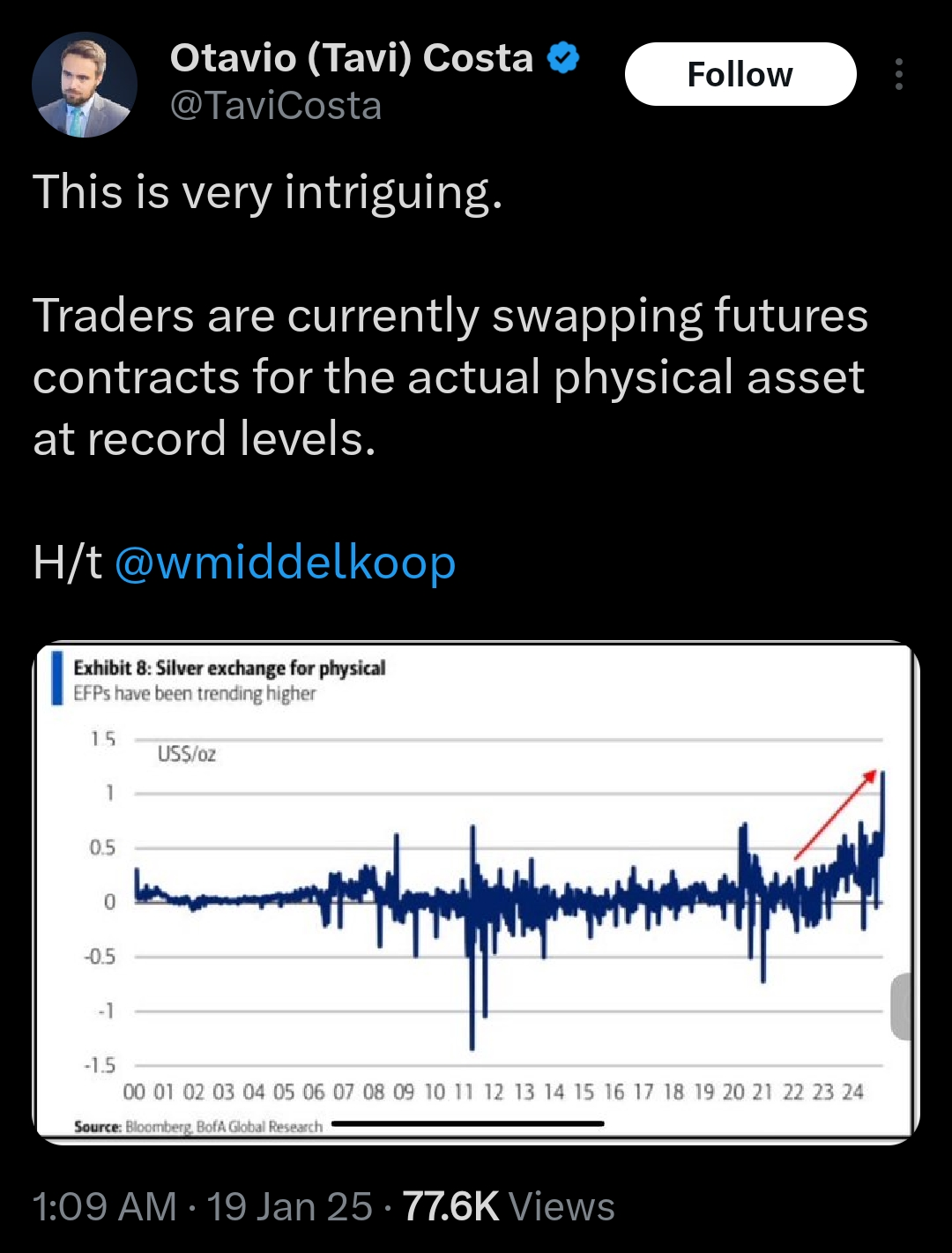

At the heart of this controversy lies the futures market, a system ostensibly designed for hedging but often accused of price suppression. Data from the Comex exchange reveals alarming patterns:

- Open Interest Changes: On 30 January, silver futures volumes reached approximately 365,000 contracts, yet the open interest only fell by 8,055 – a mere fraction amid a 40% price crash. This indicates that the sell-off primarily liquidated speculative longs, allowing shorts to cover at rock-bottom prices.

- Margin Hikes Delayed: The CME Group waited 24 hours after an initial surge to increase silver futures margins from 11% to 15%. This delay conveniently gave institutions time to exit naked shorts, flattening their risk before the reset. Why the hesitation? Speculation points to protecting bank positions while physical silver drains from vaults.

- Pending Deliveries vs. Inventory: March 2026 futures show 91,000 standing contracts, equating to about 450 million ounces pending delivery. Yet, Comex registered silver stock stands at just 105 million ounces – a classic bank run scenario. Over 3 million ounces shifted from registered to eligible categories on 29 January, signalling desperation to avoid defaults.

These mechanics highlight how futures contracts – paper promises untethered from physical supply – enable manipulation. Banks can flood the market with contracts, crashing prices to shake out weak hands & repurchase at discounts, all while physical demand soars.

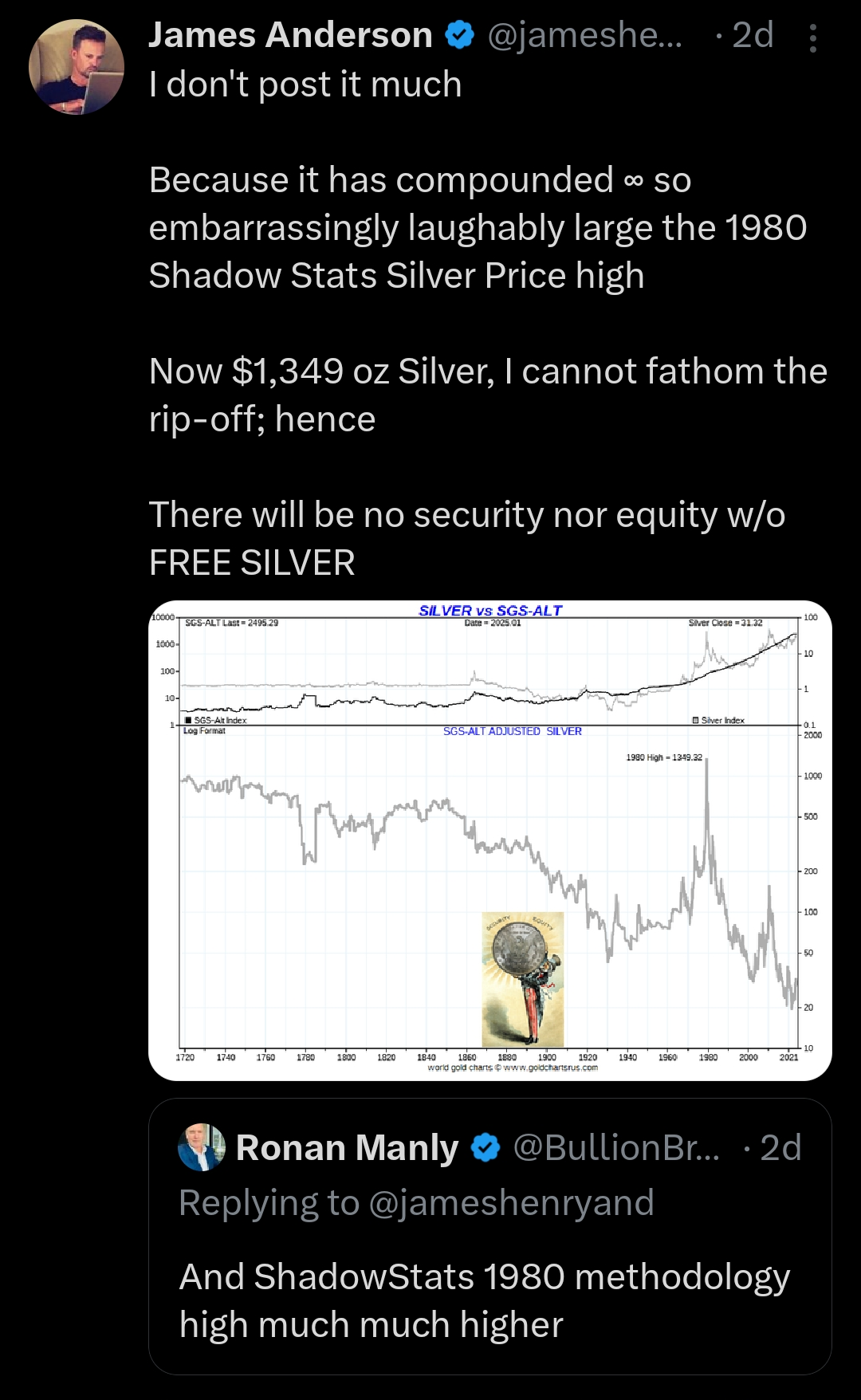

Historical Context: The Origins of Futures Rigging

This isn’t a new phenomenon. A 1974 Wikileaks cable exposes the deliberate creation of futures markets to deter “hoarding” of physical gold & silver by ordinary investors. By introducing volatility through paper trading, regulators aimed to scare retail participants away from tangible assets, preserving control for financial elites.

Fast forward to 2026, & the playbook remains the same. Institutions like JPMorgan have a history here: fined $920 million in 2020 for silver market spoofing, they now appear to have timed an $8,000 gold target upgrade just before the crash. Coincidence? Unlikely, especially as they exited shorts at the day’s lows, saving billions while retail investors bore the brunt.

The Role of Big Banks: A Coordinated Rescue?

Multiple sources describe the 30 January event as a “planned, coordinated bank rescue.” JPMorgan, in particular, is accused of pulling the “fire alarm” – initiating a massive sell-off to cover positions threatened by rising physical demand. Industrial needs alone exceed annual production, yet paper markets suppress prices to maintain the illusion of abundance.

- Arbitrage Opportunities: With silver trading at premiums in Shanghai & India (up to $60/oz spreads), Comex discounts encourage physical exports, further depleting Western vaults.

- Bank Behaviour: Upgrades from banks like Bank of America ($140/oz silver target) preceded the drop, luring in longs before the slam. This pattern – bullish calls followed by crashes – reeks of insider tactics.

Regulators, meant to oversee fairness, seem complicit. No trading halts were enforced despite 10%+ moves, allowing the vertical plunge to proceed unchecked.

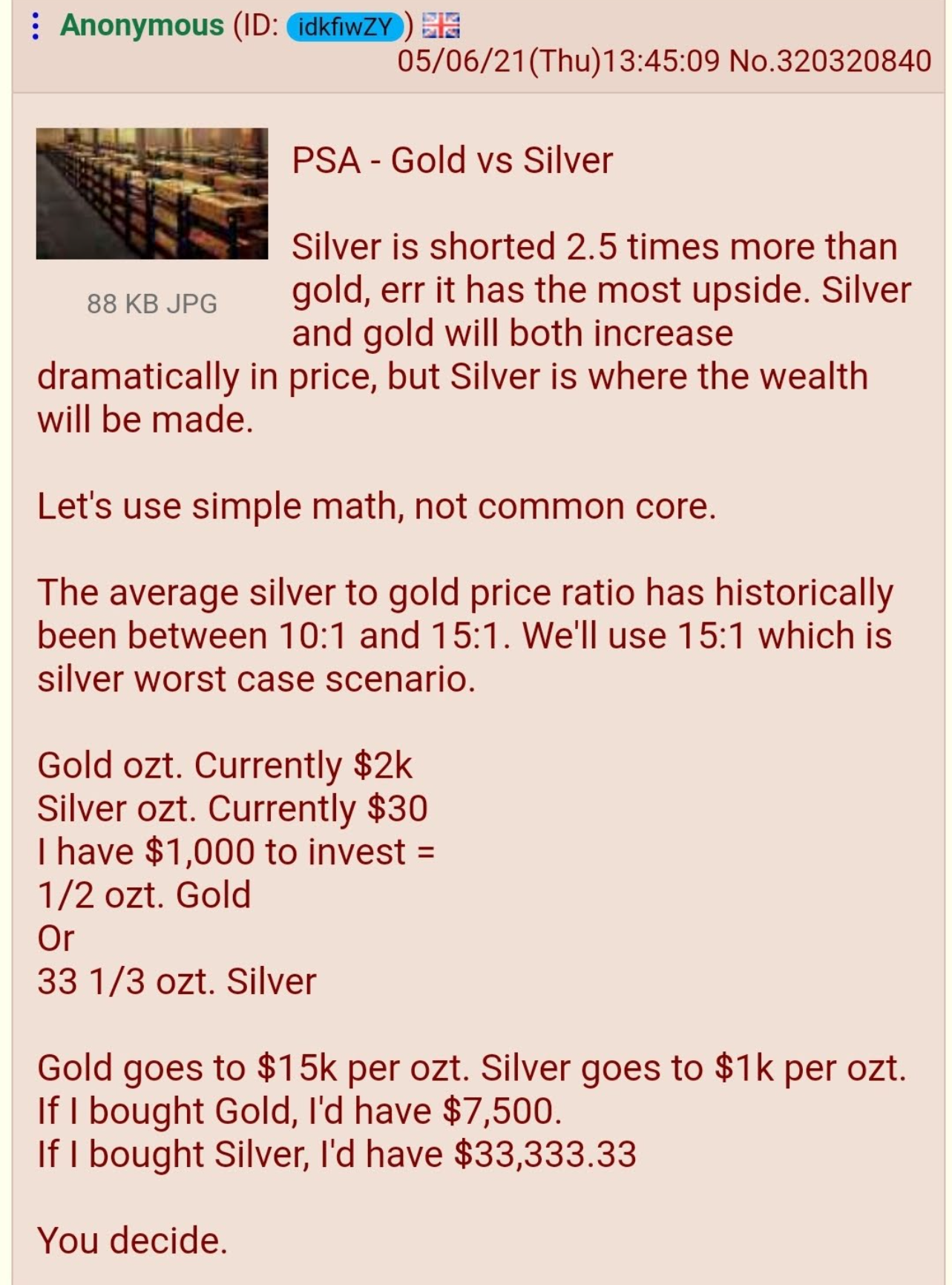

Physical vs. Paper: The True Value of Precious Metals

Amid the chaos, one truth endures: 1 oz of physical silver equals 1 oz of silver, regardless of paper prices. The crash hasn’t diminished industrial or investment demand; if anything, it exposes the disconnect. Physical markets in Asia show resilience, with Indian silver prices dipping only 14.7% over two days – far less than Comex figures.

For investors, this underscores the importance of holding physical assets. Paper futures may offer leverage, but they invite manipulation. As one observer noted, “The financial mafia is losing the war to the price discovery of real money.” With Comex vaults nearing depletion, a genuine squeeze could force prices to reflect scarcity, potentially leading to defaults or force majeure clauses.

Implications for Investors & the Path Forward

This manipulation erodes trust in financial systems, but it also presents opportunities. Savvy stackers view dips as buying signals, especially with long-term bullish formations spanning 50 years. Miners, often hit hardest in crashes, could rebound sharply as physical reality asserts itself.

To combat this:

- Demand Accountability: Push for audits of vaults like Fort Knox & stricter enforcement against spoofing.

- Diversify: Prioritise physical holdings over derivatives to avoid paper traps.

- Stay Informed: Monitor Comex data & global premiums for early warning signs.

The 30 January crash may mark the beginning of the end for unchecked futures rigging. As physical demand outpaces supply, the paper facade could crumble, ushering in fairer price discovery.

In conclusion, the evidence points to a system rigged against the average investor through futures contracts. By recognising these tactics, you can navigate the markets more effectively. Whether you’re stacking for security or speculation, remember: true value lies in the metal, not the contract. Stay vigilant as the battle between paper & physical intensifies.

If you want to start investing in precious metals & want a FREE half-ounce of silver (while supplies last), sign up for Kinesis using my link!